It’s common knowledge that the only way to have your money grow in value over time and beat inflation is to invest it. Put simply, investing means to use your money to purchase assets that increase in value, ideally at a higher rate than (a) what the bank gives you or (b) the prevailing inflation rate.

Yet for many, there’s always the fear that one might lose all of one’s money. We even hear people (often the older generation) recounting how they ‘got their fingers burnt’ while dabbling in the stock market at some point in their life, then swore never to invest their money again because investing is ‘too risky’.

But what exactly is investment risk? And why is it that certain people are able to consistently make money through investments? Are they just plain lucky? And can you actually quantify the amount of risk that you’re taking in a particular investment?

What is investment risk?

In the world of investments and finance, risk is defined as the probability of sustaining losses due to a fall in prices of whatever asset/security (stocks, bonds, real estate) you’re invested in. In other words, as long as you’re investing in something whose price moves up and down over time, you are exposed to risk.

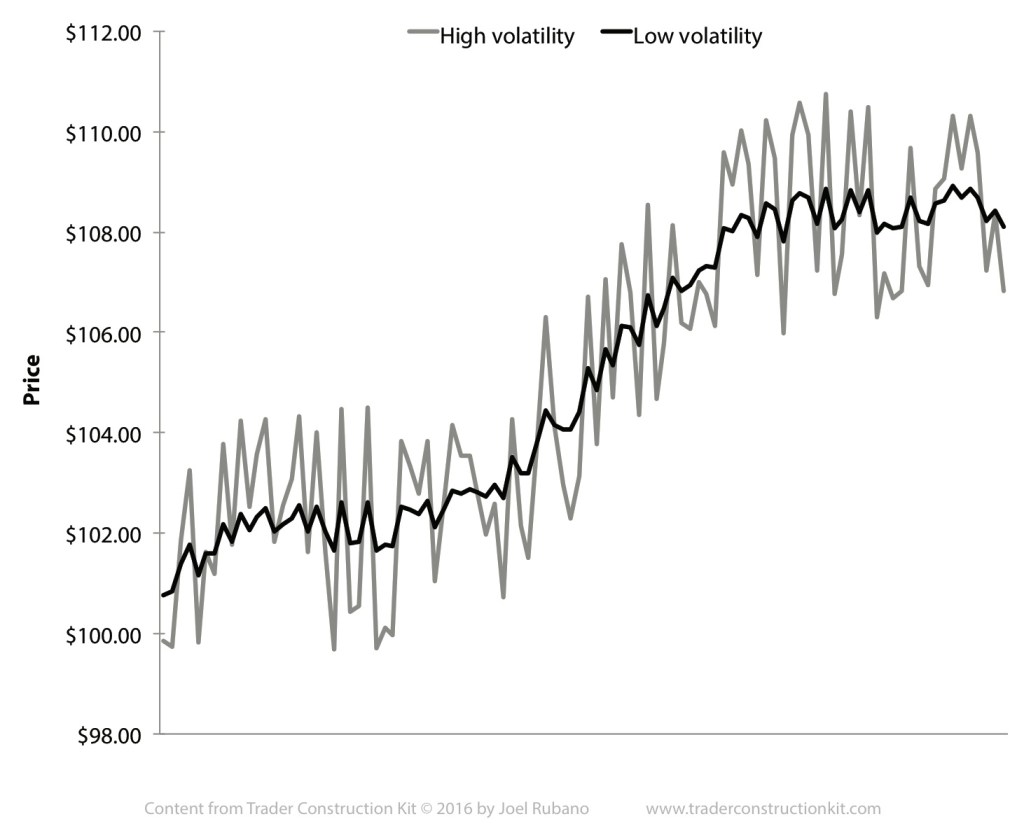

The more volatile the price fluctuation (ie. the more jagged the line), the more risky the investment.

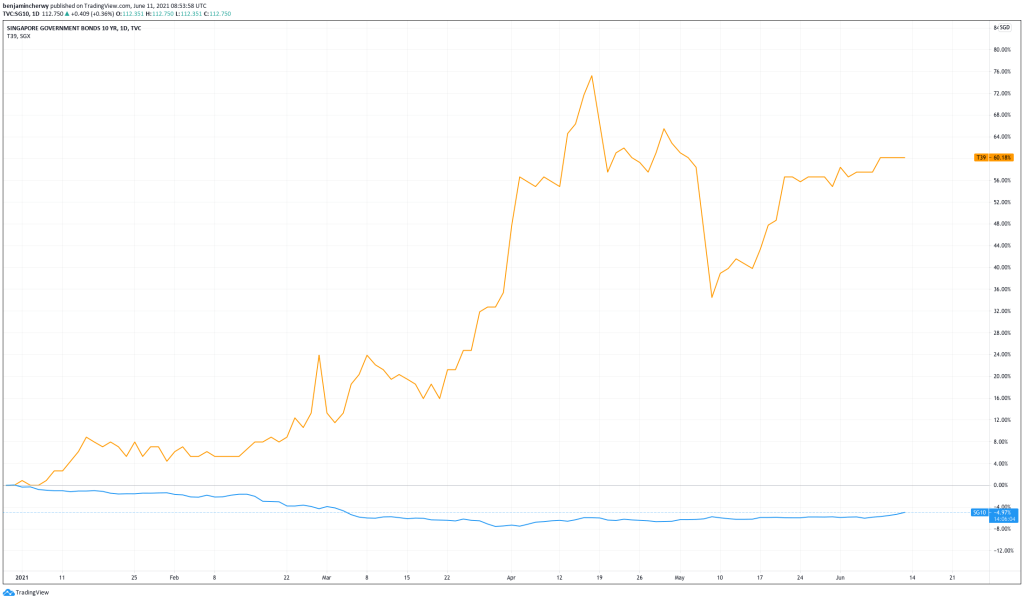

Volatility (and in turn, risk) can also vary between different asset classes. For instance, stocks are generally more volatile than bonds. While stock prices can go up by a lot, making you higher profits, they can also fall by a lot, making you bigger losses.

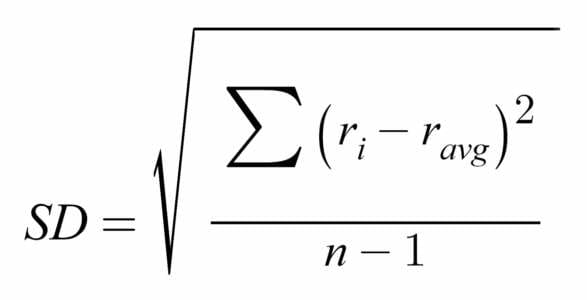

Volatility of a certain asset/security can be quantified by its standard deviation.

The higher the standard deviation, the more volatile and more ‘risky’ an asset/security is.

But what causes prices to fluctuate?

For stocks, prices fluctuate based on expected growth and earnings of the company. Put simply, the more profitable a company is expected to be, the greater the demand to own shares of that company, which in turn pushes prices up. If you know that a certain item is going to be worth twice or thrice of what it is now in the near future, wouldn’t you be more likely to be okay paying a dollar or two more for it now?

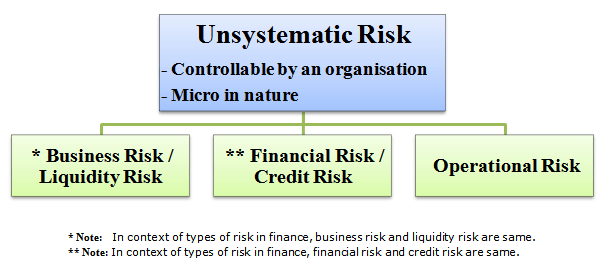

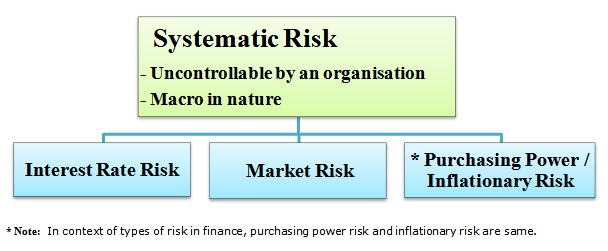

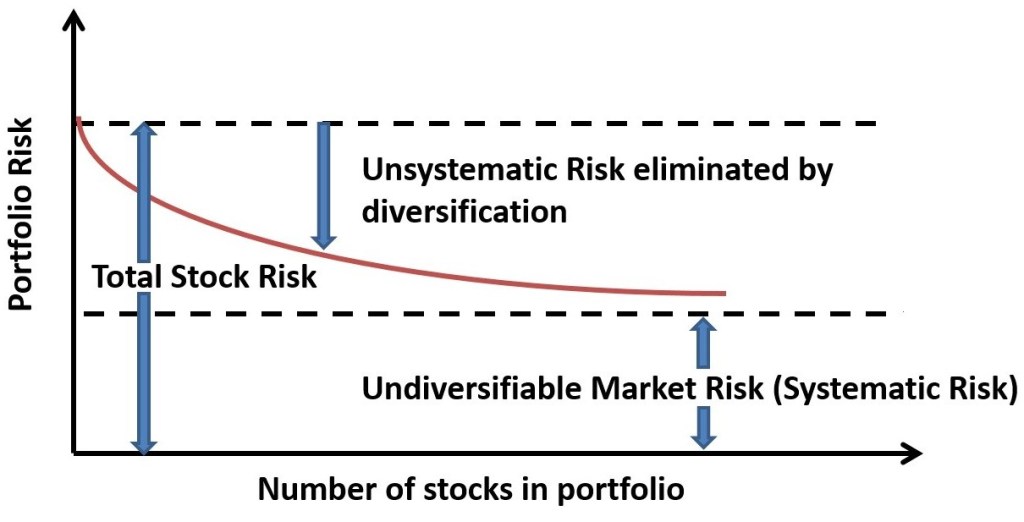

Of course, the reverse is also true. When a company is perceived/projected by investors to be less profitable, demand for its stock falls, pushing its prices down. These changes in expectations and projections can be driven by events/situations that happen to or within a company. Examples include change in management, cash flow issues, defaulting on loans etc. Such factors are also known as non-systematic risks.

There are also events that occur on a macro scale, such as political changes, inflation and interest rate changes. These are known as systematic risks.

Together, these factors contribute to the movement of asset prices, particularly in the stock and bond market, over time.

In that case, is there any way I can reduce these risks?

Whenever we consider risk management, regardless the situation, there are two main things we do. One, we try to reduce the probability of the adverse event occurring. For example, to reduce our risk of getting cardiovascular disease, we eat healthy and exercise more. Two, we take measures to reduce the impact of the adverse event. Just like how we go for the COVID-19 vaccine to prevent severe symptoms.

In investing, we do the same to manage any risks we are exposed to. First, identifying fundamentally strong companies and industries to invest in would potentially mean lower chances of them running into business or financial problems. This involves looking into the companies’ financial statements to ensure that they are healthy (eg. no over-leveraging), and even making sure that the current management has a proven track record of good business performance.

Secondly, we must be sure to diversify our portfolio across various industrial sectors and geographical regions. By not “putting all our eggs in one basket”, we’re able to minimise the downside impact in the case any one company or sector suffers. In fact, research has shown that well-diversified portfolios are able to give better risk-return ratios.

Is there such a thing as a zero-risk investment?

Unfortunately, all investments carry some degree of risk. Even keeping your money in the bank carries risk — in history, there have been instances where banks failed to return deposits, resulting in insolvency and failures. While some risks can be mitigated through means such as diversification, a certain degree of systematic risk will still remain.

Usually, these involve macro-economic events that tend to impact the large segments, or even the entire economy and market. Examples include pandemics like the recent COVID-19, political instability and other large-scale crises, that result in widespread fall in stock market prices.

However, we can put our minds at ease as these events don’t occur frequently, and the market often rebounds quickly as governments step in with stimulus packages to support the economy. In fact, historically, the average time it took for the US market to rebound from a bear market was just about 2 years, factoring in inflation and dividends.

Conclusion

Truth is, all investments are risky, but exactly how much risk you’re exposed to can be quantified. As such, measures such as good fundamental analysis and diversification can also be taken to reduce (though not completely eliminate) the risk you’re exposed to.

If you’re a new investor who’d like to find out more about how to construct a strong investment portfolio for yourself, or a seasoned veteran looking for opportunities to diversify your existing portfolio, feel free to drop me a text on WhatsApp or call me at 9622 6231. I’d be happy to share with you more any time.

Lastly, if you enjoyed reading this article and would like to see more, give my page a like on Facebook and/or follow me on Instagram for more exciting content and engagements!