Were the high interest rates previously promised to me merely just a marketing stunt?

Firstly I gotta apologise for the long hiatus. I’ve been pretty busy over the past month, catching up with clients as well as all the planning for house-moving (my family and I are moving to a new place later this year), so I kinda took a break from writing for a while.

But I’m back! And happy new year everyone!

Over the course of 2020, many of us have probably ‘fallen victim’ to at least one of the many interest rate cuts announced by the banks here in Singapore.

Some of my older relatives and clients have even made some interesting remarks, accusing the various banks of ‘playing cheat’ — initially offering high interest rates to attract customers then subsequently reducing them 😂

Well, don’t worry. Our banks are not out to cheat our money, and neither are they allowed to (because of MAS regulations, duh).

But how else, then, would one explain the numerous ‘adjustments’ in interest rates?

US Federal Reserve interest rate as a benchmark for many financial institutions

The Federal Reserve is the central bank of the United States and its federal funds rate is one of the two most widely used benchmarks by financial institutions around the world (the other being the London Interbank Offered Rate, or LIBOR).

Amidst economic slow-downs (such as in a pandemic like COVID), the Federal Reserve sometimes cuts the federal funds rate, which leads banks to do the same. This encourages both consumers and businesses to increase their spending, since large transactions (such as taking a housing loan or business loan) become more affordable due to the lower interest rates. This promotes cash flow, thereby stimulating the economy.

However, while interest rate cuts are good for borrowers and spenders, it may not bode as well for savers, since many banks also use the Fed rate as a benchmark for savings account yields. This is why, when COVID hit us in 2020 and the Federal Reserve made two emergency interest rate cuts, banks around the world did the same, cutting yields for our savings accounts.

Okay, so what are my options now?

With interest rates expected to stay low at least till 2023, many have been seeking alternatives to just parking their money in their savings accounts or fixed deposits. I did some homework myself too, and below I share 3 ways by which you can take advantage of the current situation and make the most out of your buck.

Insurance savings plans with no lock-in

Since the interest rate cuts happened last year, these bank account-like savings plans (eg. Singlife Account, Etiqa Gigantiq and Dash EasyEarn) have been all the rage. While they technically are insurance/endowment products, they behave somewhat similarly to bank accounts and offer flexibility in withdrawals. Some even go to the extent of issuing you a debit card.

Most importantly, they’re currently offering of 1.8% p.a. and up, which already beats most savings accounts and fixed deposit rates (as of 7 Jan 2021). MoneySmart has a good review and comparison of these products, so if you guys are interested you can hop there for some more information.

Refinance your home mortgage loans

If you haven’t already done so, it may be a good time to speak to your financial advisor to explore refinancing your mortgage loan. This is done by either switching to a new loan package with your existing bank (also known as repricing) or switching to another bank which may be able to offer you a lower interest rate.

Refinancing your mortgage can potentially help you reduce your monthly mortgage payments by a few hundred dollars (depending on the size of your existing loan), saving you quite a bit of expenses. But of course, there are some costs involved, such as legal fees and valuation charges, so do speak to a trusted advisor to work out the numbers and find the best solution for you.

Invest, invest, invest

For those of you who have been sitting around thinking that the markets are doing poorly because of COVID, think again. Yes, certain sectors of the economy have suffered, but there are also many industries that have thrived amidst the pandemic. The S&P 500 did see a drop in March 2020, but it has since rebounded to end the year with more than 16% growth over the 2019. Large cap technology companies like the FAANG ended 2020 near record highs. And there’s a reason to explain why.

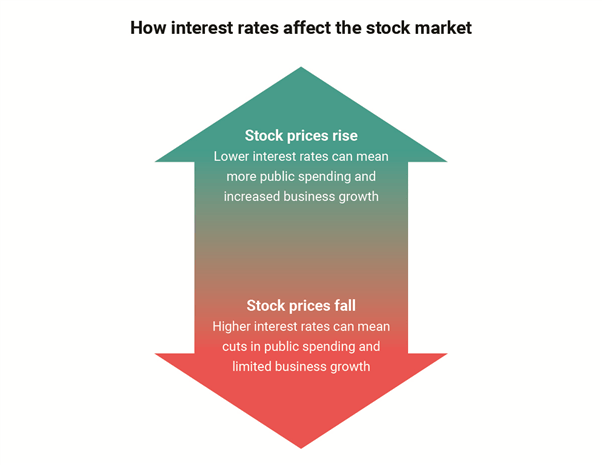

Historical data has shown a negative correlation between interest rates and stock market prices. This means when interest rates drop, stocks prices rise. Of course, the inverse is also true.

This phenomenon occurs because changes in interest rates affect companies and businesses in two main ways:

- Direct impact – Low interest rates make it more affordable for companies to borrow money to achieve growth — expanding operations, business acquisitions etc.

- Indirect impact – Low interest rates mean more disposable income for consumers, which encourages spending and in turn increases revenue for businesses.

And since stock prices reflect a company’s profitability and perceived potential for growth, a cut in interest rates often leads to a gain in stock prices.

Conclusion

When life gives you lemons, make lemonade.

While it may be a bummer to receive emails after emails from the banks about their interest rate adjustments, it also presents many opportunities for one to maximise one’s wealth. The question is, will you take that opportunity or choose to miss the boat?

Most, if not all, of my clients’ portfolios outperformed the S&P 500 last year and are more than prepared to take advantage of the market in 2021. If you’re interested, I’m more than excited to show you the numbers and answer any queries you might have. Just drop me a text on WhatsApp or call me at 9622 6231 for a non-obligatory discussion.

Lastly, if you enjoyed reading this article and would like to see more, give my page a like on Facebook and/or follow me on Instagram for more exciting content and engagements!