I’m sure many of you have read/heard about the changes to the critical illness (CI) definitions outlined by the Life Insurance Association (LIA) Singapore. A handful of you would also have heard, perhaps from friends or other advisors, that the new definitions would be ‘harder to claim’. I, for one, had several of my clients asking me if these ‘rumours’ were true.

Well, they’re not.

As reported in an article by The Business Times, some financial consultants have been trying to upsell CI policies by exaggerating the changes to CI definitions, claiming that they are going to become ‘stricter’ and therefore urging clients to ‘buy now before it’s too late’. This prompted the Monetary Authority of Singapore (MAS) to step in to put a stop to it.

“According to MAS, the LIA had in June clarified that changes to CI names and definitions were meant to provide greater clarity to CI coverage, and that there is no change to the intended scope of coverage.”

MAS acts to stop misleading sale of critical illness plans (The Business Times, 21 Aug 2020)

As a biological sciences major with some experience in the healthcare sector, I took the liberty to look through the various changes made to the CI definitions, and here are some reasons why, in contrary to the rumours, they are NOT all ‘stricter’.

Seemingly more stringent headers that actually just reinforce existing definitions

Of the 37 covered CIs under the LIA’s definitions, 14 of them had their headers changed, some of which appear seemingly more stringent (eg. the addition of the word ‘irreversible’ to a number of conditions). But upon comparison, I noticed that most, if not all, of these new headers simply reinforced what was already stated in existing definitions.

These include (but are not limited to) the following:

- Addition of ‘with Permanent Neurological Deficit’ to Stroke

- Addition of ‘Irreversible’ to Loss of Hearing/Speech/Sight/Use of Limbs

- Addition of ‘Open Chest’ to Heart Valve Surgery and Surgery to Aorta

- Addition of ‘Idiopathic’ (i.e. of unknown cause) to Parkinson’s Disease

Updated definitions that provide a ‘wider’ scope of coverage

Of the same list of covered CIs, there were 21 conditions that saw changes to their definitions. Some of these led to a ‘wider’ scope of coverage due to less ‘stringent’ requirements.

- Severe Encephalitis (previously Viral Encephalitis)

Encephalitis is an inflammation of the brain, and can result in seizures, hallucinations, trouble speaking and memory problems. New changes will include all causes of encephalitis, instead of just viral. - Blindness (Irreversible Loss of Sight)

Previous definitions required one’s vision to be measured at 3/60 or worse to meet claim requirements. New changes will soften the requirement to 6/60, which is the legal definition of blindness. - Benign Brain Tumour

New changes will remove the term ‘life threatening’ from the existing definitions as it can be debatable.

Seemingly more stringent definitions that actually just clarify the intent of coverage

On the other hand, some conditions saw the addition of new exclusions and/or diagnostic requirements to their existing definitions.

HOLD UP, DID YOU SAY NEW EXCLUSIONS? DOESN’T THAT MEAN THINGS ARE STRICTER?

Well, at first glance, these exclusions and/or requirements may make the new definitions appear ‘more stringent’ and seemingly ‘harder to claim on’. But if we look at things from a medical standpoint, we begin to understand a little better how the new definitions clarify the intent of coverage, for both policyholders and insurers.

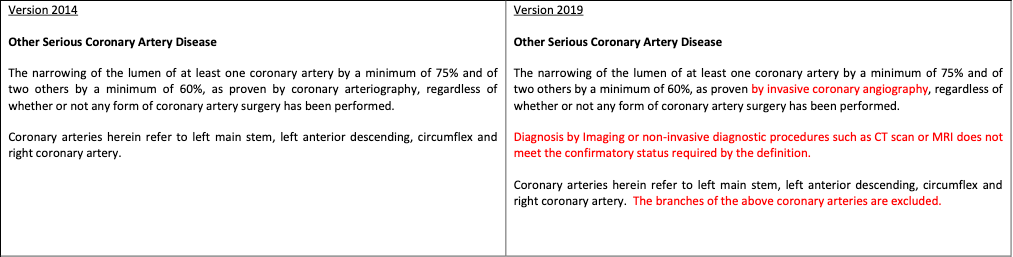

Let’s take Other Serious Coronary Artery Disease as an example:

From the new updated definition, most people would infer that CT and MRI scans will no longer be accepted in the diagnosis of coronary artery disease (CAD).

But I did some reading, and from a medical perspective, CT and MRI scans were never accepted as means of confirmatory diagnosis for CAD, due to their respective limitations. A doctor, with the use of a CT or MRI scan, can suspect that a patient has CAD, but a definite diagnosis always requires confirmation by invasive means. And coronary angiography remains the gold standard for the diagnosis of CAD around the world.

As such, by aligning itself with current medical practices, the new definition eliminates ambiguity and any potential area of conflict in the future. Examples of such changes include (but are not limited to) the following:

- Major Cancer

Addition of new exclusions that do not classify as malignant (i.e. cancerous) and minor malignancies (these were shifted to early stage definitions). - Coma

Exclusion of ‘medically induced coma’ for clarity. - Other Serious Coronary Artery Disease

Requirement for coronary angiography as a confirmatory diagnosis as CT/MRI alone is insufficient.

Okay, so now what?

All in all, in this article I just wanted to share some of my insights and thoughts about the changes in CI definitions, and the examples I listed are by no means exhaustive. If you’d like more details, you can always visit the LIA website. They have a detailed comparison of the changes between Version 2014 and Version 2019 of the CI definitions.

And most importantly, I’m not urging you be FOMO and rush to buy a CI plan right now. Buying after 25 August isn’t exactly going to affect you or your ‘claimability’ negatively. After all, the LIA’s message was pretty clear: No changes to the intended scope of coverage.

However, if you’re not yet covered for critical illness, please read my article on why CI coverage is important, and I do encourage you to start planning for it. But if you are already covered, good for you!

Nonetheless, I do feel it’s important for everyone to do a review every year or so to ensure that you and your family are still sufficiently protected based on whichever life stage you’re in. Just reach out to your financial consultant! If you do not have one yet and would like to speak to someone, I’m more than happy to have a chat with you. I’m just a text/call away. You can reach me at 9622 6231.

If you enjoyed reading this article and would like to see more, follow me on Facebook or Instagram for more exciting content and engagements!