For all you who are working/studying, chin up! It’s Friday!

First up, I’m excited to share some updates! So I qualified for my first Million Dollar Round Table (MDRT) last year and ‘received’ my award at my company’s first ever virtual (because of COVID-19) Awards Night last night.

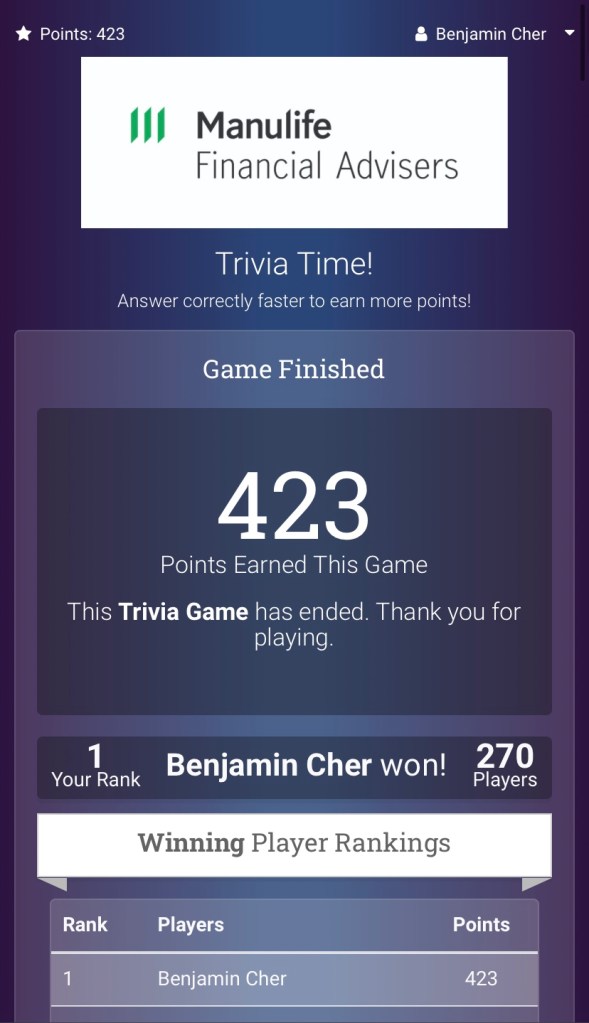

In other news, I also won the trivia quiz that was part of the celebration. Guess all that practice with Kahoots in university really paid off 😂

On a more serious note, I’m truly humbled and thankful to all my family, friends and clients who have trusted me with their financial needs since I joined the industry 2 years ago. This accolade belongs to you 🙏🏼

Anyway, people have asked me how else they can set themselves up for good financial planning, aside from investing and making sure they are sufficiently insured. Well, today I’ll be sharing 3 simple tips that you can use for your own personal financial planning, even without a financial consultant like myself.

Open a high interest saving account

I’m sure most of us have a POSB savings account, or an OCBC Frank account (because of their aesthetically pleasing VISA Debit cards). But what we might not realise is the almost negligible interest rate (approx 0.05% p.a.) that’s credited into our accounts every year. And with the average inflation rate in Singapore of about 2.1% p.a, this means that for every $100 we save in such an account, we’re essentially losing $2.05 per year.

This is why, for those of you who are working and earning an income, I recommend opening a high interest saving account. As the name suggests, by meeting certain criteria (eg. crediting your monthly salary, making a certain number of GIRO transactions per month etc), these accounts allow you to earn a higher interest than usual. Plus, you can even apply online without visiting the bank branch. MoneySmart has a good article comparing the different accounts across the various banks, and it was recently revised with the updated interest rates. The UOB One account (up to 2.5% p.a.) and DBS Multiplier account (up to 1.8% p.a.) are good options!

Live on a budget

By that I don’t mean that you have to live on bread and plain water all day. With our salary being credited into our bank accounts every month, it is very easy to spend indiscriminately without proper budgeting, blurring the lines between our needs and wants. Sticking to a budget helps us to be disciplined with our money in the long run.

If you do a simple Google search, you’ll find many different budgeting ratios that people use. Two popular ones are the 50-30-20 rule (50% for necessary expenses, 30% for wants. 20% for savings, investments and insurance) and the 40-30-20-10 rule (less than 40% for loans, less than 30% for expenses, at least 20% for savings and investments and at least 10% for insurance). There’s no fixed rule — if you don’t spend that much, then there’s nothing wrong with saving more!

Setting aside an emergency fund

While investing is important to help our money grow, it is also important for us to have access to liquid cash in case of an emergency. As discussed in my previous article about lessons to be learnt from COVID-19, I recommend setting aside at least 6 months of your expenses. This ensures that you have sufficient resources to tide yourself through at least 6 months without income.

As for the remainder of your savings, you can then diversify into a portfolio of both liquid (stocks, bonds, unit trusts/ETFs) and illiquid instruments (property, ILPs, endowments) that should propel you faster towards your financial goals.

Do you have more lobangs or tips that weren’t discussed here? Feel free to share them with me! Otherwise, happy Friday and happy weekend!

If you enjoyed reading this article and would like to see more, follow me on Facebook or Instagram for more exciting content and engagements!