If you’ve ever spoken to a financial consultant who said this to you, ki chiu!

TL;DR it really depends on what life stage you’re currently in, considering all your existing liabilities. After all, insurance is about liability protection. To find out more, read on!

While certain parts of this article may be applicable to other areas of insurance, I’ll be discussing mainly on death/disability here. For more specifics about critical illness and other areas of financial planning, do stay tuned for more.

For starters, the Life Insurance Association (LIA) Singapore recommends having 9-10 years of your annual earnings as basic life protection, but this can vary depending on individual needs. Below are 2 important factors that we should consider when determining the amount of coverage that’s suitable for you.

Family

First off, insurance is not a magic product that prevents the unexpected from happening to you. If it happens, it happens, and there is nothing we can do to control it. However, what insurance does do is protect the lives of your loved ones, should the unexpected happen to you, ensuring that their financial needs will be met, at least for a period of time, should you be no longer able to provide for them.

This is why, when determining a suitable amount of coverage, it’s important to determine the needs of those closest to you — your family. Are you currently married? Do you have kids? If so, how many and how old are they? Are your parents still working or are they retired? Do they depend on you for income?

For example, a fresh graduate in her mid-20s who just started out in her first job, who’s not married and has no children, and whose parents are both in their 50s and still actively working, may require less coverage since she has fewer liabilities.

On the other hand, consider a 40-year-old man who is married with 2 children, and whose parents are both retired and dependent on him for their living expenses. Being in the ‘sandwiched generation’ would require him to have a higher coverage due to his greater liabilities.

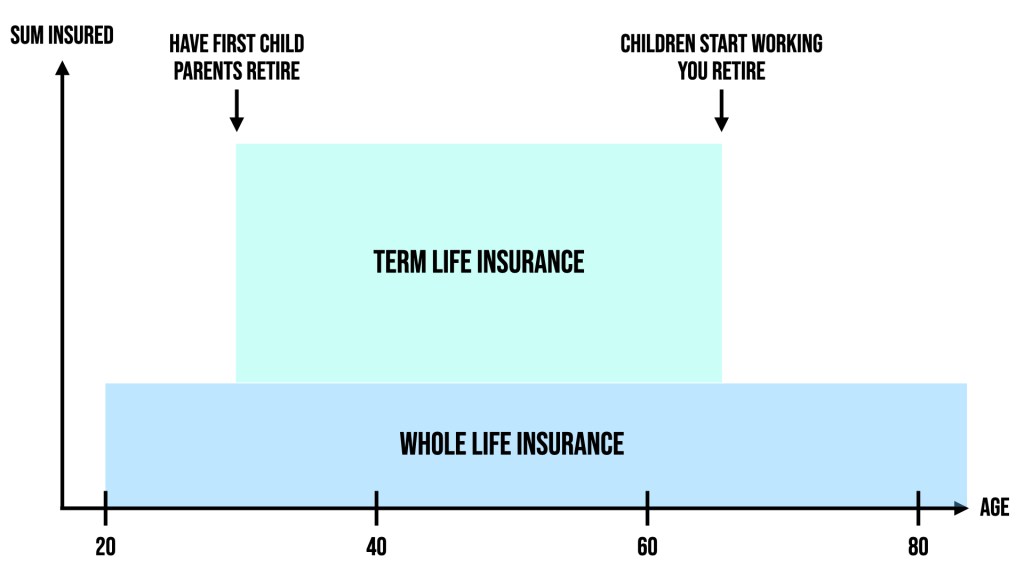

As such, I would recommend your life protection to consist of both whole life and term insurance, allowing for greater flexibility as you progress in life. For those who are younger with a lower expenses/income ratio, I would recommend looking into whole life plans as they accumulate cash value over time. You can even add optional riders that provide additional coverage such as for critical illness. Many offer limited pay options, which means you only have to pay premiums for a certain period (eg. 10, 20 years) while giving you coverage for life. Whole life plans are also a lot cheaper when you’re younger.

As you move into your 30s-40s and get married and have kids, your expenses will get comparatively higher. In this case, you can top up your existing coverage with term life plans which provide higher coverage for cheaper premiums. As your children grow older and your liabilities decrease, you then have the flexibility to terminate these plans to lower your life protection and save money.

Loans

In Singapore, it is not uncommon for people to take up loans, especially for housing and cars. These loans also contribute to our total liabilities, and should also be taken into consideration when doing protection planning. This ensures that, should anything untoward happen to you, your family won’t have an extra problem to deal with (eg. having to pay mortgage). I’m pretty sure the last thing anyone would want to see is their family being forced to sell their home because they can’t afford the mortgage.

To meet this need, I would recommend you look at decreasing term insurance. Decreasing term means that your coverage drops over time as you pay off your loan (i.e. lesser liability), tapering down to zero by the end of your loan repayment period. This allows premiums to be relatively cheaper. Many of such plans also offer a joint life option, meaning that the plan covers two people (usually you and your spouse). Should anything untoward happen to either one of you, the insurance payout will settle your remaining loan.

All in all, there’s no hard-and-fast rule to how much insurance we actually need. My personal opinion is that anything between 5-10 years of your annual income is reasonable, depending on where you are in life and considering the cost of premiums as well. Ultimately, financial planning is an ongoing process, which is why your financial consultant calls you every once in a while for a policy review.

So the next time he/she calls you, do take the opportunity to review your existing policies with him/her and see if your coverage is still relevant. Of course, if you do not already have a consultant and would like to speak to someone, feel free to drop me a text or a call. I’d be happy to have a chat with you. 😊

If you enjoyed reading this article and would like to see more, follow me on Facebook for more exciting content and engagements!